SA Fine-Tuned Trading (Pty) Ltd

Investor Login Area - A Deeper Look

SA Fine-Tuned Trading (Pty) Ltd

Wildlife, Agriculture, Forestry & Tourism stocking

Contact Details

Investment Range Required

R15,000,000 for operational expansion and wildlife

Type of Investment Required

Capital Expenditure

Infrastructure Funding

Working Capital

Financial Projections (2025-2027)

| Metric | 2025 | 2026 | 2027 |

| Revenue | R15,000,000 | R28,000,000 | R45,000,000 |

| Gross Margin | 60% | 62% | 65% |

| EBITDA | R3,000,000 | R8,400,000 | R16,200,000 |

| Net Profit Margin | 14% | 20% | 28% |

| Break-even Point | Achieved 2024 |

Revenue Growth Drivers:

- Wildlife population maturation enabling hunting operations

- Lodge occupancy scaling from 35% to 75%

- Premium pricing through biodiversity node certification

- Export market development for processed products

Expected Outcomes / Impact

Economic Impact

- Create 75+ permanent jobs by 2027 (25 immediate, 50 seasonal during peak periods)

- Generate R45 million in annual revenue, contributing to regional GDP

- Support 150+ indirect jobs through the supply chain and community procurement

- Establish an R50+ million asset base through wildlife, infrastructure, and equipment

Social Impact

- 70% target for women in processing and value-addition activities

- Youth training and mentorship programmes with 50+ participants annually

- Community development fund allocation of 2% of annual revenue

- Preferential procurement targeting 60% local supplier participation

Environmental Impact

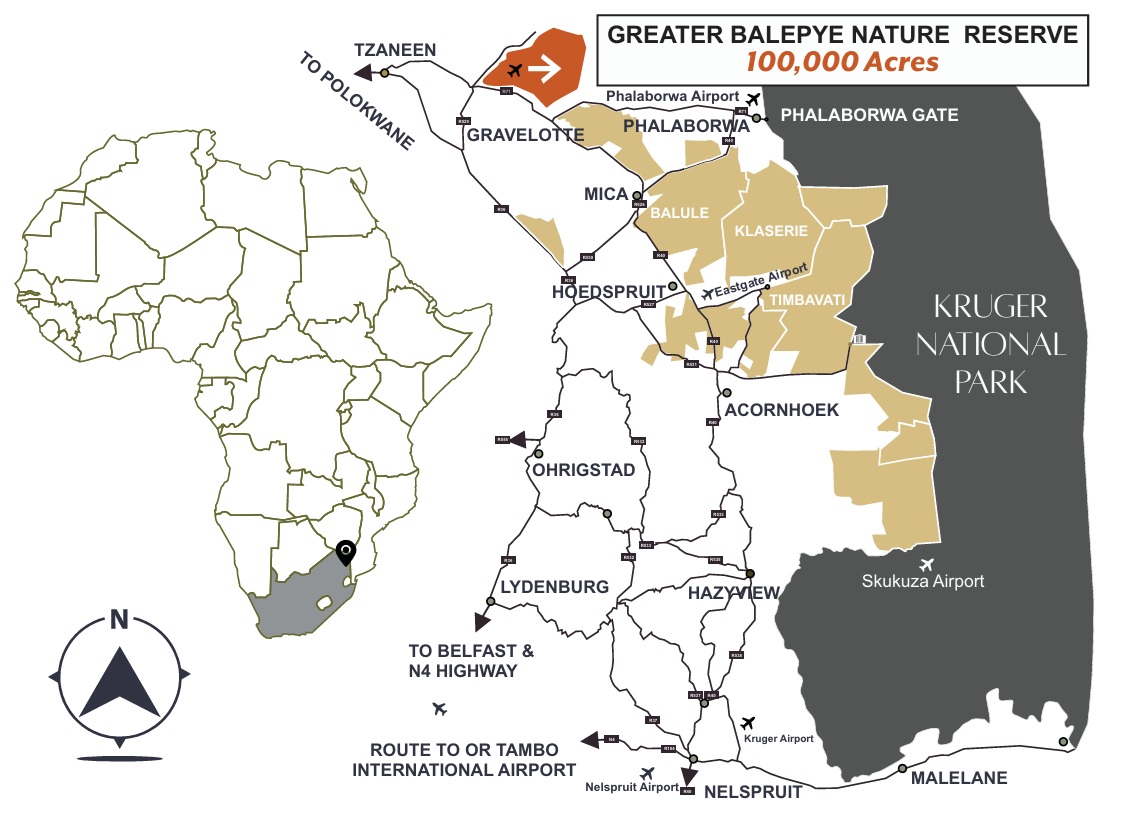

- Rehabilitate 4,200 hectares of degraded land to natural ecosystem functions.

- Achieve carbon neutrality through renewable energy and sequestration practices.

- Restore indigenous wildlife populations supporting regional conservation goals.

- Implement zero-waste circular economy principles across all operations

Transformation Impact

- Demonstrate 100% Black-owned success in the wildlife industry worth R4.3 billion annually.

- Create a replicable model for biodiversity economy transformation

- Contribute to the government's rural development and job creation objectives

- Support South Africa's National Biodiversity Strategy implementation

Investment & Use of Funds

Total Raise: R15,000,000 for operational expansion and wildlife introduction

Use of Funds

- R8,000,000 – Wildlife stocking programme (Big Five and plains game)

- R3,000,000 – Operational capital and working capital requirements

- R2,000,000 – International marketing, brand development, and distribution

- R1,500,000 – Equipment, vehicles, and technology systems

- R500,000 – Product development and certification programmes

Return Projections

- Target 35-45% annual ROI on invested capital

- 5-year cumulative return of 6-8x initial investment

- Exit opportunities through strategic acquisition or management buyout

- Potential carbon credit revenue providing additional return streams

The Team

Mlungisi Sonwabile Bushula – Managing Director & Founder

- 5+ years of experience in agricultural and forestry enterprises

- Educational background: Public Management (Nelson Mandela University), Financial Management (Damelin / Milpark)

- Award recognition: 2017 Small-Scale Forestry Award, 2019 YAFF Large-Scale Category Winner

- Extensive networks within government, conservation, and agricultural sectors

- Proven track record in project management and stakeholder engagement

Proposed Key Personnel (to be recruited with investment):

- Operations Manager (PDI): Wildlife/agriculture degree, 5+ years of experience

- Head Professional Hunter: International certification and experience

- Lodge Manager (PDI): Hospitality management qualification and experience

- Financial Manager (PDI): CA(SA) or equivalent professional qualification

- Conservation Manager: MSc Conservation Biology, research coordination experience

Strategic Partnerships:

- Department of Forestry, Fisheries and Environment (DFFE)

- South African National Parks (SANParks)

- Department of Agriculture, Land Reform and Rural Development (DALRRD)

- Wildlife Ranching South Africa (WRSA)

- Professional Hunters Association of South Africa (PHASA)

Risk Assessment & Mitigation

| Risk | Mitigation Strategy |

| Wildlife Disease Outbreaks | Comprehensive veterinary programmes, quarantine protocols, and insurance coverage |

| Tourism Market Volatility | Revenue diversification across hunting, photographic, and domestic markets |

| Regulatory Changes | Active engagement with industry bodies, compliance management systems |

| Climate / Environmental Impact | Water storage systems, adaptive management practices, and climate insurance |

| Skills Shortage | Training programmes, partnerships with educational institutions, and competitive remuneration |

| Currency Fluctuations | USD pricing for international clients, forward exchange contracts |

| Infrastructure Delays | Contingency planning, multiple contractor relationships, and phased implementation |

Exit Strategy

Possible Exit Options:

- Strategic Acquisition: Sale to established wildlife, tourism, or agricultural operators seeking transformation credentials and Eastern Cape expansion

- Private Equity Partnership: Buyout by impact investment funds focused on conservation and transformation

- Management Buyout: Structured divestment to the management team through performance based arrangements

- Government Partnership: Enhanced partnership with SANParks or provincial development agencies

- Sector Consolidation: Participation in broader biodiversity economy sector consolidation

Recent Comparable Transactions:

- Wildlife operations in Eastern Cape trading at 4-6x EBITDA multiples

- Conservation-focused enterprises attracting premium valuations due to ESG focus

- Transformation operators receiving preferential terms from impact investors

Unique Value Proposition for Exit:

- 100% PDI ownership with established government partnerships

- Diversified revenue model reducing single-sector risk

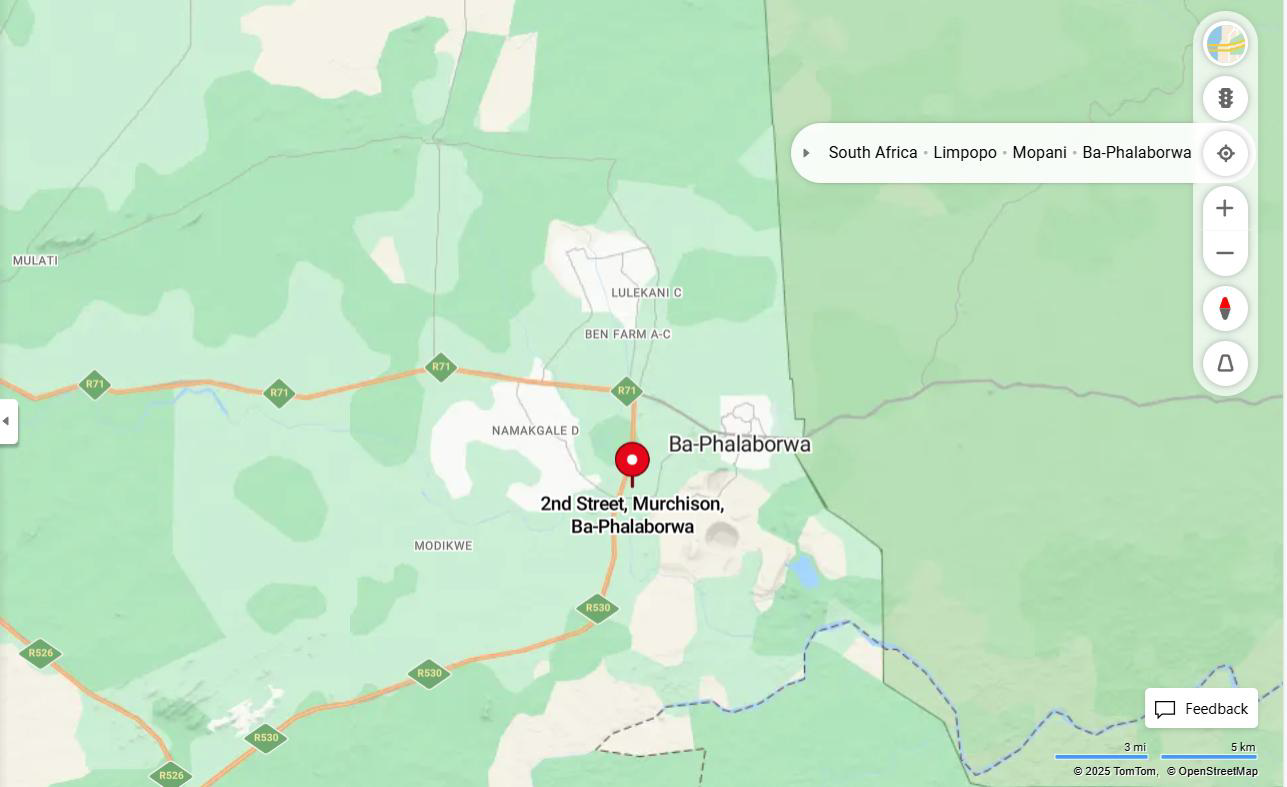

- Strategic location within an established biodiversity economy node

- Demonstrated conservation impact and community development outcomes

- Scalable business model suitable for regional expansion

Attachments Available on Request

- Environmental Impact Assessment and Approval Documentation

- DFFE-EPIP funding agreements and disbursement schedules

- Financial statements and projections (detailed 5-year model)

- Land lease agreements and tenure documentation

- Professional hunter and tourism operator certifications

- Conservation management plans and biodiversity assessments

- Community development agreements and stakeholder engagement records